Weekly Market Update October 31, 2022

Weekly Market Update, October 31, 2022

Presented by Zachary R. Sturdy

General Market News

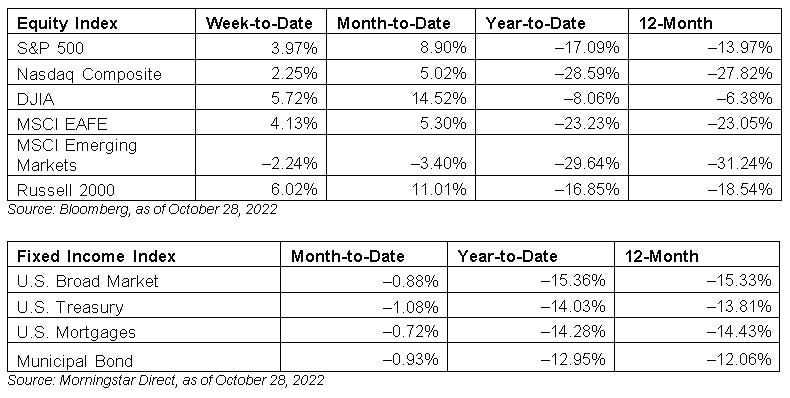

· With the Federal Open Market Committee (FOMC) heading into its November meeting this week, consensus expectations point to a likely rate hike of 75 basis points (bps). As rates continue rising, we’re starting to see more market participants voice their concern that the Federal Reserve (Fed) may be going too far and/or too fast. Fed Chair Jerome Powell has seen an uptick in political pressure with calls to ease up on hikes, but hasn’t revealed any signs of bending as he aims to maintain the independence of the central bank and bring inflation down considerably. His words will be closely monitored at the post-meeting press conference on Wednesday, looking for indications of how the rate path may progress from there. U.S. Treasury yields were down across the curve last week. The 2-year, 5-year, 10-year, and 30-year dropped 25 bps (to 4.27 percent), 32 bps (to 4.16 percent), 21 bps (to 4.01 percent), and 21 bps (to 4.13 percent), respectively.

· Equity markets moved higher despite a rough week of earnings for a number of FAANG names. Meta Platforms (META), Amazon (AMZN), and Alphabet (GOOGL) all reported earnings and sold off to various degrees despite mixed results. The worst of the three was Metaverse (META), which was down 23.7 percent, with the stock missing operating profit expectations as it continues to invest heavily into building out its alternative and virtual reality platforms. The company remains in a very difficult and costly transitional phase from traditional social media to this new, interactive environment. Amazon also reported and, while the numbers came in a bit light, the biggest news was softer fourth-quarter/holiday season sales guidance—down roughly 7 percent on the consumer side—and lower Amazon Web Services profitability—down 13.3 percent. Alphabet (GOOGL) also reported a large earnings per share (EPS) miss of roughly 15 percent below expectations as YouTube came in weaker than expected amid an advertising spend slowdown. Finally, last week’s positive news came via Apple (AAPL), which beat revenue and EPS slightly on higher-than-expected MAC revenue despite softer iPhone sales volume.

· Last week’s data provided insight into the health of both the consumer and the overall economy. Tuesday saw the release of the Conference Board Consumer Confidence Index for September. Consumer confidence declined by more than expected during the month, breaking a streak of two consecutive months with rising confidence.

· On Thursday, the preliminary estimates for durable goods orders and third-quarter GDP were released. Both headline and core durable goods orders came in below expectations in September, signaling slowing business spending. The GDP report showed that the economy rebounded and grew during the third quarter, following a 0.6 percent decline in the second quarter. This better-than-expected result was driven by improvements for international trade, as exports surged while imports slowed.

· Finally, Friday saw the release of the personal spending and personal Income reports for September. Both personal income and spending increased, marking two consecutive months with strong spending growth and signaling continued strength for the American consumer.

What to Look Forward To

This week will see the release of data related to the consumer and overall health of the US economy. Tuesday will see the release of the ISM Manufacturing index for October. Manufacturer confidence is expected to decline modestly during the month yet remain in expansionary territory. On Wednesday, the FOMC meeting rate decision will provide insight into the future path of rates.

Thursday will see the ISM Services index for October. Service sector confidence is also expected to decline modestly in October, which would mark two consecutive months with declining service sector confidence.

Finally, Friday will see the release of the employment report reports for October. The pace of hiring is set to slow again in October; however, even with the anticipated slowdown, hiring is expected to remain solid on a historical basis.

Disclosures: Certain sections of this commentary contain forward-looking statements that are based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. All indices are unmanaged and are not available for direct investment by the public. Past performance is not indicative of future results. The S&P 500 is based on the average performance of the 500 industrial stocks monitored by Standard & Poor’s. The Nasdaq Composite Index measures the performance of all issues listed in the Nasdaq Stock Market, except for rights, warrants, units, and convertible debentures. The Dow Jones Industrial Average is computed by summing the prices of the stocks of 30 large companies and then dividing that total by an adjusted value, one which has been adjusted over the years to account for the effects of stock splits on the prices of the 30 companies. Dividends are reinvested to reflect the actual performance of the underlying securities. The MSCI EAFE Index is a float-adjusted market capitalization index designed to measure developed market equity performance, excluding the U.S. and Canada. The MSCI Emerging Markets Index is a market capitalization-weighted index composed of companies representative of the market structure of 26 emerging market countries in Europe, Latin America, and the Pacific Basin. The Russell 2000® Index measures the performance of the 2,000 smallest companies in the Russell 3000® Index. The Bloomberg US Aggregate Bond Index is an unmanaged market value-weighted performance benchmark for investment-grade fixed-rate debt issues, including government, corporate, asset-backed, and mortgage-backed securities with maturities of at least one year. The U.S. Treasury Index is based on the auctions of U.S. Treasury bills, or on the U.S. Treasury’s daily yield curve. The Bloomberg US Mortgage Backed Securities (MBS) Index is an unmanaged market value-weighted index of 15- and 30-year fixed-rate securities backed by mortgage pools of the Government National Mortgage Association (GNMA), Federal National Mortgage Association (Fannie Mae), and the Federal Home Loan Mortgage Corporation (FHLMC), and balloon mortgages with fixed-rate coupons. The Bloomberg US Municipal Index includes investment-grade, tax-exempt, and fixed-rate bonds with long-term maturities (greater than 2 years) selected from issues larger than $50 million. One basis point is equal to 1/100th of 1 percent, or 0.01 percent.

###

Zachary R. Sturdy is located at 307 S. Front St., Ste: 107 Marquette MI, 49855 and can be reached at (906)226-6056.

Securities and Advisory Services offered through Commonwealth Financial Network, member FINRA/SIPC, a Registered Investment Adviser. Fixed insurance products and services offered through CES Insurance Agency.

Authored by the Investment Research team at Commonwealth Financial Network.

© 2022 Commonwealth Financial Network®