Weekly Market Update November 7, 2022

Weekly Market Update November 7, 2022

Presented by Zachary R. Sturdy

General Market News

· Last Wednesday brought the Federal Open Market Committee (FOMC)’s latest rate decision where it hiked the policy rate by 75 basis points (bps) for the fourth consecutive time. This brought the upper target of the central bank’s rate up to 4 percent for the first time since January of 2008 during the global financial crisis. As for the future path of the central bank's policy rate, Federal Reserve (Fed) Chair Powell left room for flexibility but indicated that the Fed “will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.” While this might hint at a transition to a smaller rate hike in December, Powell went on to reiterate the “higher for longer” narrative that’s been developing, saying, “We still have some ways to go and incoming data since our last meeting suggests that the ultimate level of interest rates will be higher than previously expected.” U.S. Treasury yields were up across the curve last week. The 2-year, 5-year, 10-year, and 30-year gained 33 bps (to 4.75 percent), 19 bps (to 4.38 percent), 14 bps (to 4.16 percent), and 4 bps (to 4.19 percent).

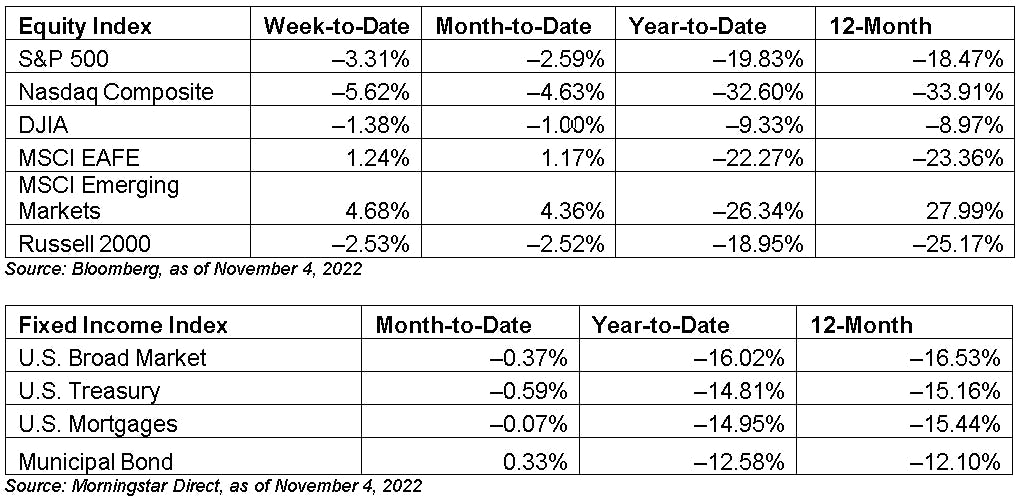

· Equity markets struggled last week amid discussion of a higher end target rate for the Fed. The result was a swift sell-off in riskier equities such as technology and consumer discretionary. The week’s stronger-than-expected employment report didn’t help the case for lower rates as strong employment data continued to make the case for further tightening and higher rates from the Fed. International equities stood out, particularly emerging market equities. Rumors via the New York Times and Financial Times of a move away from the Covid-19 zero policy in China lifted the market. Finally, earnings season remained mixed with earnings growing at a rate of just 2.2 percent in the third quarter, per FactSet. Major themes thus far have been mixed results from Covid-19 stocks, foreign exchange headwinds, travel momentum, and weaker ad spending. Energy continues to carry earnings this quarter; however, if the energy sector was excluded, earnings would have fallen 5.4 percent for the third quarter according to FactSet. Not surprisingly, energy, materials, and industrials were the best-performing sectors last week.

· Last week’s data focused on the health of the manufacturing and services segment of the economy. The week also wrapped with the October employment report. But the most important news was the FOMC decision on Wednesday.

· Tuesday saw the release of the ISM Manufacturing Index for October. Manufacturer confidence declined by slightly less than expected, and the index now sits at its lowest point since mid-2020—which signals headwinds for the manufacturing industry.

· Wednesday was Fed day, as the Fed hiked the federal funds rate by 75 bps at its November meeting, which was in line with expectations. Fed Chair Powell indicated that the central bank is likely to hike again at its upcoming meeting in December as well as into 2023.

· On Thursday, the ISM Services report for October was released. Service sector confidence fell by more than expected, but the index remained in expansionary territory despite the decline.

· Finally, Friday saw the release of the employment report for October. More jobs than were expected were added in October and the September report was revised up as well. The unemployment rate increased by more than expected during the month yet remained low on an historical basis.

What to Look Forward To

This week’s data will focus on inflation and the consumer.

Thursday will see the release of the Consumer Price Index for October. The report is set to show continued inflationary pressure, with headline prices set to rise by 0.7 percent.

Friday will see the release of the preliminary University of Michigan consumer sentiment survey results for November. Consumer sentiment is set to decline modestly, which would break a four-month streak of improving confidence.

Disclosures: Certain sections of this commentary contain forward-looking statements that are based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. All indices are unmanaged and are not available for direct investment by the public. Past performance is not indicative of future results. The S&P 500 is based on the average performance of the 500 industrial stocks monitored by Standard & Poor’s. The Nasdaq Composite Index measures the performance of all issues listed in the Nasdaq Stock Market, except for rights, warrants, units, and convertible debentures. The Dow Jones Industrial Average is computed by summing the prices of the stocks of 30 large companies and then dividing that total by an adjusted value, one which has been adjusted over the years to account for the effects of stock splits on the prices of the 30 companies. Dividends are reinvested to reflect the actual performance of the underlying securities. The MSCI EAFE Index is a float-adjusted market capitalization index designed to measure developed market equity performance, excluding the U.S. and Canada. The MSCI Emerging Markets Index is a market capitalization-weighted index composed of companies representative of the market structure of 26 emerging market countries in Europe, Latin America, and the Pacific Basin. The Russell 2000® Index measures the performance of the 2,000 smallest companies in the Russell 3000® Index. The Bloomberg US Aggregate Bond Index is an unmanaged market value-weighted performance benchmark for investment-grade fixed-rate debt issues, including government, corporate, asset-backed, and mortgage-backed securities with maturities of at least one year. The U.S. Treasury Index is based on the auctions of U.S. Treasury bills, or on the U.S. Treasury’s daily yield curve. The Bloomberg US Mortgage Backed Securities (MBS) Index is an unmanaged market value-weighted index of 15- and 30-year fixed-rate securities backed by mortgage pools of the Government National Mortgage Association (GNMA), Federal National Mortgage Association (Fannie Mae), and the Federal Home Loan Mortgage Corporation (FHLMC), and balloon mortgages with fixed-rate coupons. The Bloomberg US Municipal Index includes investment-grade, tax-exempt, and fixed-rate bonds with long-term maturities (greater than 2 years) selected from issues larger than $50 million. One basis point is equal to 1/100th of 1 percent, or 0.01 percent.

###

Zachary R. Sturdy is located at 307 S. Front St., Ste: 107 Marquette MI, 49855 and can be reached at (906)226-6056.

Securities and Advisory Services offered through Commonwealth Financial Network, member FINRA/SIPC, a Registered Investment Adviser. Fixed insurance products and services offered through CES Insurance Agency.

Authored by the Investment Research team at Commonwealth Financial Network.

© 2022 Commonwealth Financial Network®