Weekly Market Update October 17, 2022

Weekly Market Update, October 17, 2022

Presented by Zachary R. Sturdy

General Market News

· The front end of the yield curve continued its rise last week, lifted by hotter-than-expected inflationary data. The inversion between the 2- and 10-year U.S. Treasury yields expanded to 50 basis points (bps) and the spread picked up another 8 bps between the two yields. The inversion reflects the Federal Reserve (Fed)’s efforts to cool near-term demand and the economy by raising the shorter-term debt beyond longer-dated debt. The 2-, 5-, 10-, and 30-year Treasuries moved 20 bps (to a 4.50 yield level), 13 bps (to a 4.27 yield level), 12 bps (to a 4.01 yield level), and 13 bps (to a 3.98 yield level), respectively.

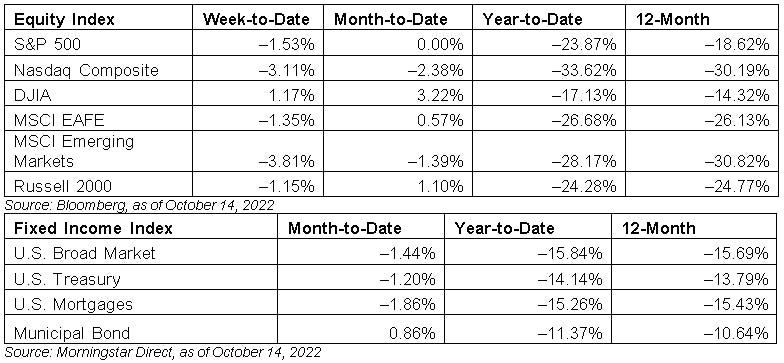

· The S&P 500 and Nasdaq Composite indices were down last week while the blue chips of the Dow Jones Industrial Average moved slightly higher. It was a volatile week of trading with wide intraday swings, particularly on Thursday following Wednesday’s hotter-than-expected Consumer Price Index (CPI) data. Consumer staples, health care, and financials were among the top-performing sectors as investors flocked to relative safety. Several large banks had earnings last week, with revenue and earnings coming in slightly better than expected—1.1 percent and 1.2 percent, respectively, for those that reported. That said, the provisions for loan losses (i.e., potential for bad debt) increased to $10.5 billion for S&P 500 banks that have reported thus far.

· Sectors that struggled last week included consumer discretionary, technology, and utilities. Consumer discretionary was hit by expectations that short-term rates would continue to move higher as part of Fed policy. The auto sector was weaker with Tesla (TSLA) down 8.1 percent, and the technology sector struggled as the chip sector was hit by new government-imposed restrictions regarding advanced technology exports to China. The PHLX Semiconductor Index, which is commonly used as a benchmark for the semiconductor industry, was down 8.3 percent.

· Last week’s data focused primarily on inflation and the consumer. Tuesday saw the release of the Producer Price Index, which tracks the change in prices received by domestic producers for their output. Producer prices rose more than expected, with core and headline prices both seeing larger increases than predicted.

· Wednesday’s CPI report was much anticipated and consumer inflation also came in above expectations in September. The continued high levels of producer and consumer inflation support the Fed’s plans for further rate hikes at its November and December meetings.

· Thursday and Friday saw the release of September retail sales and the preliminary estimate for the October University of Michigan consumer sentiment report. Headline retail sales were unchanged following an upwardly revised 0.4 percent increase in August. Core sales increased modestly as consumers slowed their purchases of larger discretionary items. Consumer sentiment improved more than expected, as improving consumer views on current economic condition supported improvement for the index. Future expectations soured, driven by rising expectations for short- and long-term inflation.

What to Look Forward To

This week’s data will primarily focus on the housing market, which has been a key factor behind recent elevated inflation data. Homebuilder sentiment, housing starts, building permits, and existing home sales are all on the docket.

Tuesday will see the release of the National Association of Home Builders Housing Market Index for October. Home builder confidence is expected to drop, driven by a slowdown in homebuyer demand.

Wednesday will see the release of housing starts and building permits for September. Permits are set to rise modestly during the month while September starts are expected to drop.

Finally, Thursday will see release of the existing home sales report, which is expected to show a continued decline in September and would mark 8 consecutive months with slowing home sales.

Disclosures: Certain sections of this commentary contain forward-looking statements that are based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. All indices are unmanaged and are not available for direct investment by the public. Past performance is not indicative of future results. The S&P 500 is based on the average performance of the 500 industrial stocks monitored by Standard & Poor’s. The Nasdaq Composite Index measures the performance of all issues listed in the Nasdaq Stock Market, except for rights, warrants, units, and convertible debentures. The Dow Jones Industrial Average is computed by summing the prices of the stocks of 30 large companies and then dividing that total by an adjusted value, one which has been adjusted over the years to account for the effects of stock splits on the prices of the 30 companies. Dividends are reinvested to reflect the actual performance of the underlying securities. The MSCI EAFE Index is a float-adjusted market capitalization index designed to measure developed market equity performance, excluding the U.S. and Canada. The MSCI Emerging Markets Index is a market capitalization-weighted index composed of companies representative of the market structure of 26 emerging market countries in Europe, Latin America, and the Pacific Basin. The Russell 2000® Index measures the performance of the 2,000 smallest companies in the Russell 3000® Index. The Bloomberg US Aggregate Bond Index is an unmanaged market value-weighted performance benchmark for investment-grade fixed-rate debt issues, including government, corporate, asset-backed, and mortgage-backed securities with maturities of at least one year. The U.S. Treasury Index is based on the auctions of U.S. Treasury bills, or on the U.S. Treasury’s daily yield curve. The Bloomberg US Mortgage Backed Securities (MBS) Index is an unmanaged market value-weighted index of 15- and 30-year fixed-rate securities backed by mortgage pools of the Government National Mortgage Association (GNMA), Federal National Mortgage Association (Fannie Mae), and the Federal Home Loan Mortgage Corporation (FHLMC), and balloon mortgages with fixed-rate coupons. The Bloomberg US Municipal Index includes investment-grade, tax-exempt, and fixed-rate bonds with long-term maturities (greater than 2 years) selected from issues larger than $50 million. One basis point is equal to 1/100th of 1 percent, or 0.01 percent.

###

Zachary R. Sturdy is located at 307 S. Front St., Ste: 107 Marquette MI, 49855 and can be reached at (906)226-6056.

Securities and Advisory Services offered through Commonwealth Financial Network, member FINRA/SIPC, a Registered Investment Adviser. Fixed insurance products and services offered through CES Insurance Agency.

Authored by the Investment Research team at Commonwealth Financial Network.

© 2022 Commonwealth Financial Network®